Homeownership is Possible Today!

This article is somewhat inspiring, from the perspective that there is so much being written and spoken about the housing crisis, but what we really need today is action! We do not need more facts and figures to describe this crisis; it’s well covered and documented.

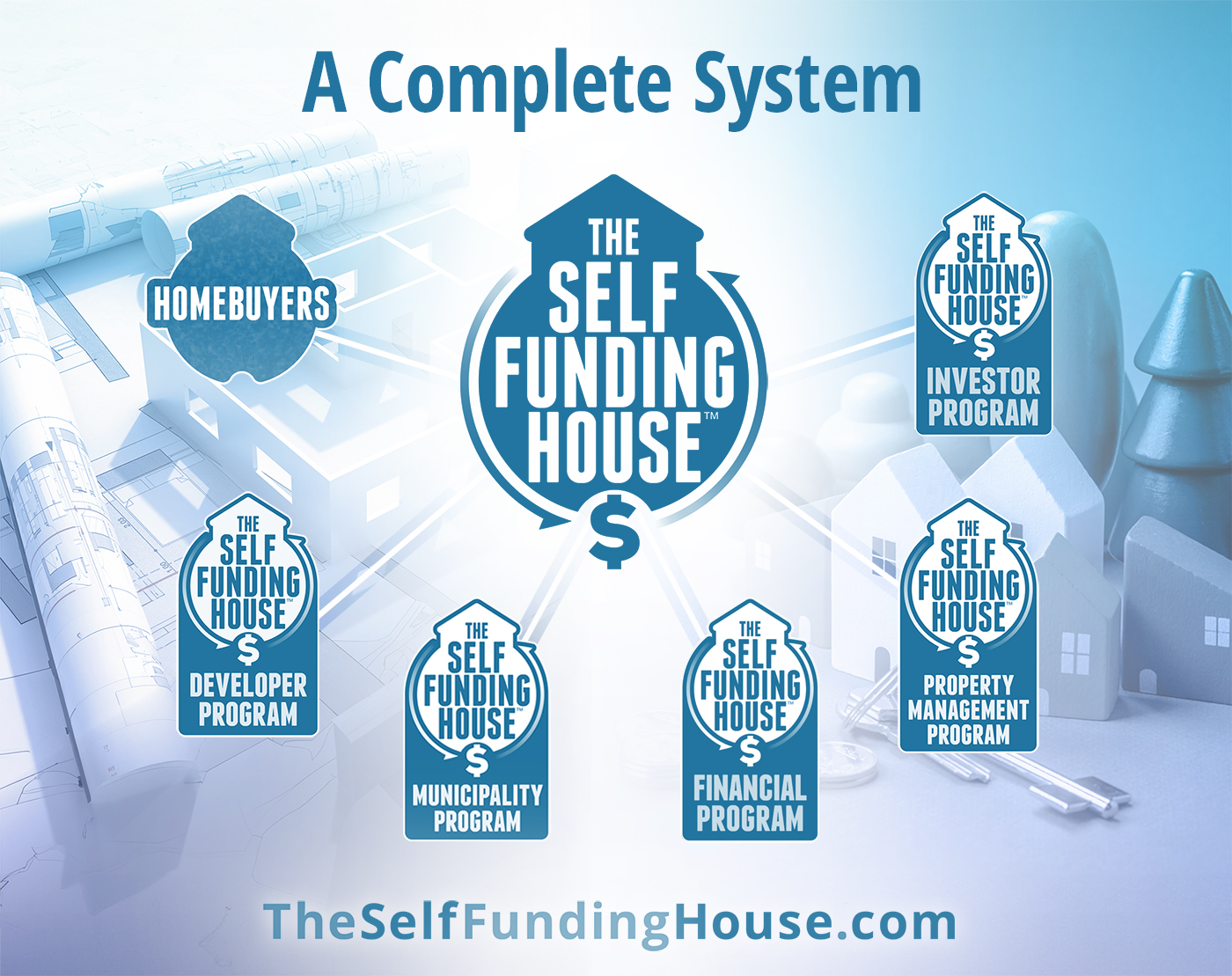

When Derek Lobo and I created The Self Funding House™ concept, resulting in a series of books and online learning portal, we realized that if anything was to change we needed to act, not wait for the government to solve the challenge.

While it is true that homeownership is clearly out of reach for many North Americans, that conclusion is only accurate through the lens of traditional and historical paths to home ownership. The younger generations of Millennials and Gen Z are impacted the most, and they have proven themselves to be determined and innovative.

The Self Funding House™ aims to change the mindset of the homebuyer in order to accomplish affordability in today’s economic climate. I am writing this article as a proactive next step to the MacLean’s article, essentially refuting their conclusion that homeownership is not possible (their facts tell an accurate story, but only through the limited frame of a narrow lens).

There are two primary ways to accomplish affordability: one is lower the cost of the house (but land, construction, and other costs are inflexible), or two, increase the income of the homebuyer.

The thesis of The Self Funding House™ is to treat the home as a business by becoming a landlord of a basement apartment or ADU (Accessory Dwelling Unit). This brings additional affordable rentals into the market, sometimes at almost half the cost of local market rents. This concept directly impacts the income of the homebuyer, and affordability can be accomplished by having the rental income count towards mortgage qualification—a huge step for many potential home buyers!

After a successful pilot project, The Self Funding House™ has become a complete system, pulling together the stakeholders needed to make things happen now. Even though still in the early stages, this is already having an impact for homebuyers (who need affordability) and builders (who need to increase sales).

Rod Schulhauser, P. Eng

President

The Self Funding House Inc.